Budgeting is a word that can strike fear and anxiety to the hearts of many. But it doesn’t have to be complicated. In fact, some of the most effective budgeting methods are surprisingly simple. In this article, we will talk about easy-to-follow budgeting tips that will help you take full control of your finances. By the end of this, you will learn how to better track your spending, set realistic goals, and create a budget that actually works for you. So, let’s ditch the stress and embrace a simpler approach to managing your money.

Track Your Expenses

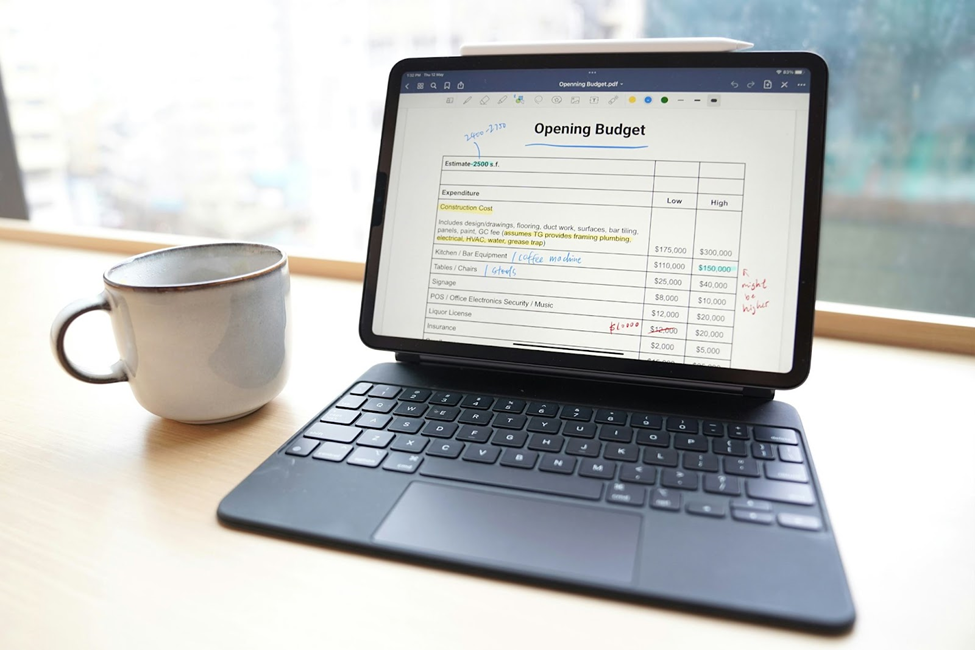

Before even creating a budget, you need to understand where your money is going. Track all of your expenses for one whole month using a spreadsheet, a budgeting app, or go old school with a notebook. This will help you identify areas where you can cut back a little or increase your budget some more. If you’re in Texas, consider shopping affordable electricity plans from Amigo Energy.

Create A Realistic Budget

Once you have a clear picture of your spending habits, create a budget that reflects your income and expenses. The 50/30/20 rule is a popular budget method. This means allocating 50% of your income to needs like rent, utilities, or groceries. Then, 30% goes to wants like entertainment, dining out, or beauty products). Finally, 20% of your income should go to your savings and debt repayment.

Set Financial Goals

Always ask yourself: What are you saving for? From here, you can determine to which you’re setting your financial goals. Some other questions include: Is there a down payment for anything that you need to prioritize?

Do you want to go on your dream vacation this year? Setting clear and achievable financial goals will motivate you to stick to your budget.

Automate Your Savings

Set up automatic transfers to your savings account each month. This helps you save effortlessly and ensures you consistently put money aside for your savings account.

Reduce Recurring Expenses

Identify which areas in your life you’re having recurring expenses. This could be anything from monthly subscriptions to gym memberships and streaming services. If you can, reduce some of these expenses, especially if you realize you don’t get to use them that often.

Cook and Prepare More Meals at home

Eating out can be really expensive. Cook and prepare more of your meals at home to significantly reduce your cost on food and takeouts.

Pack your Lunch

As mentioned above, eating out or ordering takeout can be costly. So, bringing your lunch to work can definitely save you a considerable amount of money each month.

Find Entertainment at Home

Instead of spending money on expensive entertainment, find ways to enjoy yourself from the comfort of your home. This could include reading, listening to music, watching movies, or even playing online games.

For instance, instead of commuting to an actual casino place, you can wager on your favorite basketball teams and check out NBA Odds for the season at home. This gives you an entertaining and potentially rewarding experience without the need for costly travels to a physical casino.

Shop Smart

Compare prices, use coupons, take advantage of discounts and promos to get the best deals on groceries and other essentials.

Find Ways to Increase Your Income

Consider getting a side hustle, such as freelancing, driving for ride-sharing services, or selling little crafts and trinkets online. This will help you increase your income and savings in the long run.

Create An Emergency Fund

Creating an emergency fund can put your mind at ease because this can eventually be your source of money when you need to pay unexpected expenses like medical bills, car repairs, or sudden job loss. Aim for at least 3 to 6 months of living expenses in an easily accessible account.

Wrapping Up

Budgeting is an ongoing process. Regularly review and adjust your budget as needed to reflect changes in your income and expenses. Don’t get discouraged if you don’t stick to your budget perfectly every month. The key is to consistently make progress towards your financial goals.